The complete guide to creating a life science marketing strategy and plan

Introduction

What’s the secret to successful life science marketing and communications?

Whatever you offer, from pipettes, glassware and consumables to high end microscopes, mass spectrometers, DNA sequencers and research services, you want to make sure that scientists and life science professionals take notice.

A well-researched marketing strategy and carefully constructed tactical plan will help you stand out from the competition and make your company more competitive, robust and profitable. This is equally true regardless of whether you are marketing a product or a service. The start point for any marketing activity should always be to develop a clear plan aligned to your business objectives. Before defining your marketing tactics, it is vital to understand the unique benefits of your offering, and how they line up against the pain-points and challenges of your target markets.

How can you do this?

In one word: research.

The foundation for any life science marketing communications plan is based on primary knowledge of your marketplace. What are your customers looking for? What do they value? How do they perceive the benefits offered by your organisation? And what do they think about your competitors?

Just as importantly, what does your internal team think about these factors? Is everyone in your organisation aligned? Are they able to effectively communicate the unique value you offer the marketplace? It may be that your company is already some (or all) of the way through this process, but it’s always useful to regularly revisit the data and assumptions your marketing strategy is built on.

Once you’ve collected this information, you can use it to define your core market proposition, set SMART marketing objectives to aim for, shape your strategy, plan your tactical arsenal and identify your preferred metrics to track your performance.

A well thought-through life science marketing plan is critical for business success. Most importantly, it will help to ensure you maximise the ROI of your marketing spend. In this eBook, we provide a seven-stage process to help you define your marketing strategy and suggest tips for putting together a tactical marketing plan focussed on delivering against your business goals.

"A well thought-through life science marketing plan is critical for business success. Most importantly, it will help to ensure you maximise the ROI of your marketing spend."

Stage 1.

Gathering customer insight and developing your proposition

People don’t just have relationships with individual products; they are usually loyal to brands. Without investing time in developing, refining and implementing your brand proposition, you will have no differentiation in the marketplace. Without differentiation, there is limited opportunity for your products to gain long-term profitability.

Building a unique position in the life science market

So how do you go about crafting a unique positioning to stand out from the crowd? A good start is a brand audit: a detailed analysis of your brand and its current state.

An audit will help to determine which of your brand qualities are currently effective and which are not. You can use this to help restructure your identity and messaging in order to produce better results.

The purpose of an audit is to establish several key brand attributes:

- How it’s perceived by important stakeholders, e.g. employees, customers, suppliers, partners, distributors, prospects, etc.

- What its strengths and weaknesses are

- How well known and regarded it is

- How it sits against its competitors within the marketplace

- What its core values are

- How well these values are mapped to the goals, needs and challenges of its various audiences

- How best to define your brand’s positioning so that it resonates with your targets.

Reviewing existing market research

There is a raft of market research available both free of charge and for a fee on the internet. These are extremely useful in providing background information and context to the landscape within which you are operating. For example, you might use such data to estimate the size (and opportunity) of a given market vertical, or use it to fine-tune your message to appeal to the most lucrative market segment.

There are several great sources for market research in the life science and healthcare sectors:

- Frost & Sullivan

This group has developed a team of consultants and research analysts who are global experts on the life science market. This team not only provides global coverage of the marketplace, but also – and more importantly – gives you a global perspective of the market. - SlideShare

Free of charge market research presentations from a variety of sources are hosted on SlideShare. For example, Allied Research, shared this report on the ‘Global In Vitro Diagnostic Market’, while Visiongain shared a free executive summary report on the ‘Point of Care Diagnostic Market Forecast 2014–2024’. Other summaries include this report on the ‘2016 Global Life Science Funding & Lab Budget Outlook’. Just be aware that most of these SlideShare presentations are tasters designed to encourage you to buy the full report. - MarketResearch.com

The database at MarketResearch.com is a comprehensive collection of market intelligence products and services. It offers reports from over 720 top publishers and offers instant access to a wealth of expert insights on global industries, companies, products, and trends. - Bioinformatics, LLC

This group provides market intelligence to major suppliers serving the life science, medical device and pharmaceutical industries. - Membership organisations

Organisations that you and your company belong to are likely to be able to give you access to industry reports. For example, each year the American Association of Clinical Chemistry (AACC) presents a global market report on the in vitro diagnostic (IVD) market at its annual meeting. - Global management consultancy firms

Companies such as EY publish regular reports on the healthcare and life science market on their websites, which are available to download and digest. For example, EY’s Megatrends Report provides detailed information on the global forces that will have a far-reaching impact on business, economies, industries, societies and individuals. This includes a section on the global trends affecting the healthcare market. - Life science analysts and publishers

A number of publishers offer access to life science intelligence services, including the likes of Scrip Intelligence, BioCentury, Informa and Evaluate.

As you can see, some thorough digging around on the internet can provide a cost-effective way of gaining valuable insight into your market.

Internal audit

Market research data can provide some useful big picture insights, but what about your prospects and customers specifically? Well, before reaching out to them, it’s critical to first look at the brand from the inside out.

It’s likely that there’s a great deal of insight already lurking right under your nose: your sales, after-sales and technical teams probably already know a substantial amount about your customers. Scientific products are invariably associated with a large amount of technical details. But this is detail that these internal teams deal with on a daily basis – that’s what makes them first line experts! Your first port of call in gathering insight should therefore be with the very people that are already working very closely with your intended customers.

An internal audit typically includes a combination of quantitative and qualitative research. This involves polling key internal team members, from executives and managers to customer service and sales personnel, to reveal their ideas, insights and feelings about your brand. It is vital to take a snap shot of people across the organisation as the thoughts and opinions of the senior management could be far removed from others within the company. The aim is to get a rounded picture of how your team views the company, including its strengths, weaknesses, positioning against competitors and unique proposition in the marketplace.

The research activity would usually combine:

- Quantitative research: online survey (only really useful if the company has a large number of employees to interview, i.e. over 50)

- Qualitative research: focus groups, in-person interviews, interviews via email, etc.

Its purpose is to gather intel on the management team’s and employees’ perceptions of:

- The company: it’s mission, differentiators, strengths and weaknesses

- Products/services: understanding of the product/service offering, their benefits, how they compare to the competitions

- Competitors: who the key competitors are, what makes them better/worse, what differentiates the brand from its competitors

- The brand: what the brand’s personality and core values are.

External audit

Another great tactic to accumulate useful insight is to go straight to the source. The person most informed about the customer’s needs and concerns is the customer. You can start by reaching out to existing customers and set up a brief interview call. If a customer is happy with their product, it’s unlikely they’ll mind a quick five-to-ten-minute chat about their impressions. Similarly, if they’re unhappy they’re probably going to want to explain why! All feedback is good feedback and so you should take every opportunity to get it straight from the horse’s mouth.

It’s important to remember that those customers in charge of the buying decision may not necessarily be the end-users. Lab managers for example may go to great lengths to source the right equipment, but may never actually use it themselves. This means that while the buyers may be well informed about what they need, they may be less knowledgeable about day-to-day uses or even problems.

To overcome this you could organise a visit to the customer’s workplace, allowing you to see the product in action. This also gives you the fantastic opportunity to speak directly to those making use of your product. Users will be likely to speak openly and honestly when in their place of work.

Customers are not the only external stakeholder to consider when carrying out your research. Within the life science arena, there is a vast range of audiences that often need to be taken into account (see table).

To help create a compelling proposition for your brand, you need to be clear about whom you are targeting, the constraints they are working within and how you can encourage them to take action. The outcome of the external audit will enable you to adjust the impetus and depth of your messaging to suit each target audience, so your communications efforts will always resonate.

Once again, the best approach to adopt is a combination of quantitative and qualitative research for current customers, prospective customers, past customers and suppliers.

Competitor analysis

A competitor analysis will help to build a wider picture of the marketplace and help to establish where you fit within your competitive set. This can be done through online research, mystery shopping (via the phone and at trade shows), requesting sales materials and even speaking to your customers and prospects for their opinions on your competitors.

SWOT (Strengths, Weaknesses, Opportunities and Threats) or Gap analyses can be used to establish your existing and desired position against your competitors. A SWOT analysis is a traditional marketing technique that can help you to identify the biggest opportunities within your market and align them against your company’s strengths. This helps you to focus on those areas where you are most likely to win.

A Gap analysis is often more organic and flexible than a SWOT analysis. It compares the gap between your actual performance against your potential performance.

Typically you would detail your current state and your desired state, before developing a comprehensive plan to fill out the gap between the two. As an example, this type of analysis might demonstrate that your product is head and shoulders above any other product in the market, but no one has ever heard of it and therefore hasn’t even considered buying it! In this case, the analysis would help you to define your positioning and apply tactics to build the profile and awareness of the product, overcoming the ‘awareness gap’.

Once you have gained a clear picture on the scope of products and/or services offered by your key competitors, you can perform an in-depth analysis of how they position themselves in the market via their communications and sales collateral. All of this will help to outline where there may be a gap in the market and how you can define a unique position for your brand, products and services.

Communications audit

More often than not, businesses will unintentionally have a relatively disparate appearance and voice running throughout their different marketing communication channels – particularly if there isn’t a strict corporate approval process to which everyone adheres. The end result being that potential buyers are unclear on exactly what makes you different, what value you offer or why they should buy into you (and from you).

As part of a brand audit, it is useful to take a cross section of communication materials and run a communications audit looking at the usage of fonts, imagery, colours, messaging and tone of voice. This would include analysing various materials: brochures and flyers, your website, annual reports, infographics, podcasts, internal communications, press releases, exhibition stands, training materials, application notes, white papers, case studies and webinars. The purpose of this is to understand where to make improvements in the clarity of the brand’s positioning.

The criteria we tend to review in a communications audit includes:

- Messaging

- Tone of voice

- Fonts

- Colours

- Imagery

- General

"To help create a compelling proposition for your brand, you need to be clear about whom you are targeting, the constraints they are working within and how you can encourage them to take action."

Stage 2.

Analysing the data

A typical brand audit will produce a lot of data (we often produce hundreds of PowerPoint slides when feeding back our initial analysis to a client!). While this raw data is interesting and useful, you will need to distil it down into the core findings and themes if you want to make effective use of it.

An effective approach involves translating this data into a series of short documents, which will form the basis of the programme moving forward. These are:

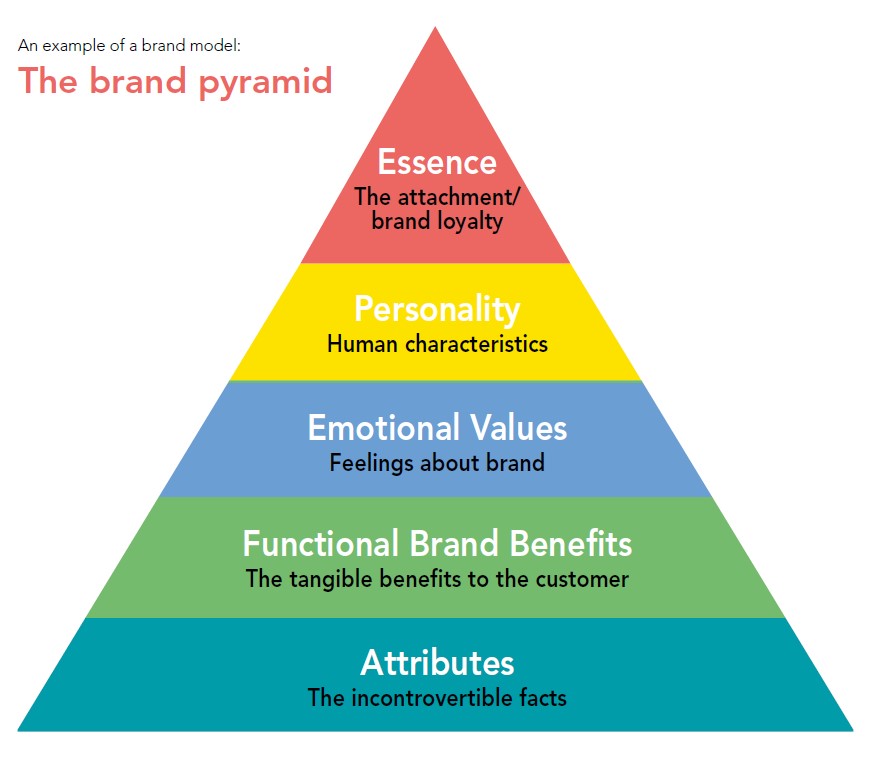

- The company’s brand model (often defined as a brand pyramid or brand platform)

- A buyer persona document for each of the key prospects your company is targeting.

Developing your brand model and/or brand platform

Once you have collated all the data from the brand audit, you can use it to define your company and its offering, including your USPs and key benefits statements. The best way to do this is using a brand model and/or a brand platform (see below for an example). The information can be utilised to create a strategy that will deliver success, built on messages that will resonate with customers.

Defining your buyer personas

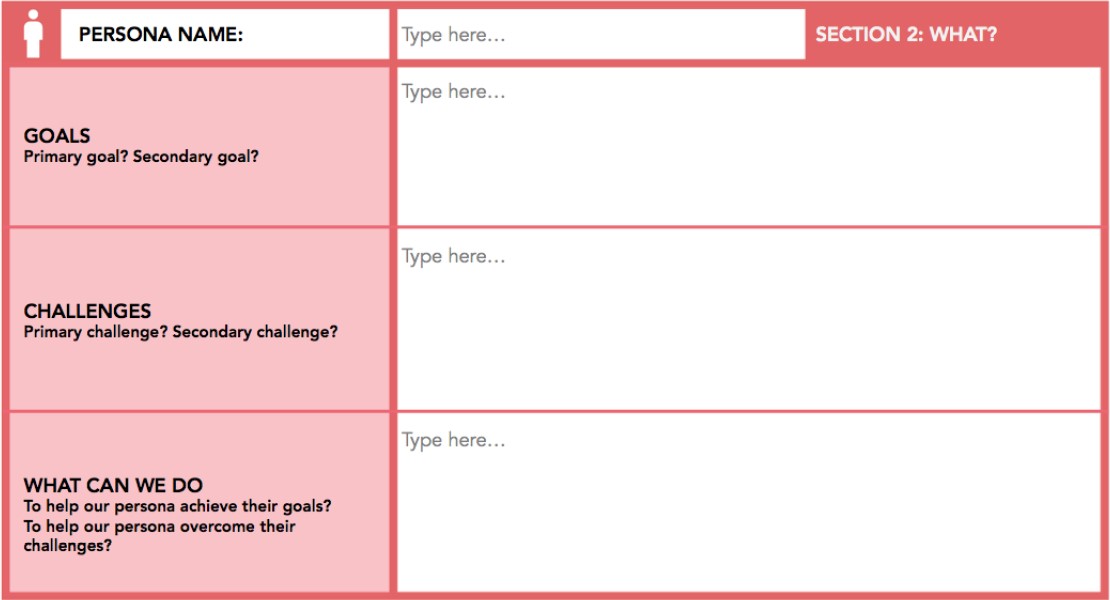

Having defined your proposition in the form of a brand model, the next stage is to gather relevant information about your prospective customers and develop your buyer persona documents. The best-laid plans can quickly go awry if you haven’t built them on a strong foundation.

Buyer personas help you define exactly who you are targeting and how you can demonstrate the value of your offering. They typically include sections on their individual goals, challenges and pain points, as well as ideas on how your products/services can help.

Buyer personas can also be a good place to start compiling information designed to nurture prospects through the sales process e.g. a list of proof points you have available in order to overcome common sales objections.

Ensuring that you have an accurate picture of you customers’ needs, pain-points and objectives will prove to be invaluable for guiding your marketing activities. When interviewing internal and external stakeholders during your brand audit, you should include questions that will help you later develop your buyer personas.

With your brand model and buyer personas in hand, you are well prepared to set your marketing strategy, define your goals and to begin to build out a tactical marketing plan.

Stage 3.

Reviewing your sales process and defining your marketing strategy

Now that all the groundwork is complete and you are clear on how to position your company, who your buyers are, what will motivate them to buy, and where your opportunities are in the market, you are in a strong position to define your marketing strategy. Needless to say, this relies heavily on all the research that has been undertaken up to this point. However, you will need to link this directly to the business challenges you face. Many of these relate to optimising your sales process and pipeline.

The sales strategy

Perhaps your product is not well-known or respected in the marketplace; maybe your sales team is struggling to close deals, as they are unable to show the product in action; perhaps you are getting leads but few are converting into customers. Make sure you think carefully about the strategy you adopt to overcome these issues.

Whatever your strategy, always remember: revenues are the lifeblood of most companies, and revenues are driven by sales. As such, you need to define your strategy with this in mind, i.e. how will it help you to raise awareness of your offering, attract the interest of your prospects, nurture them into leads and close them as customers?

Below are some examples of life science marketing strategies:

- As our product is not well-known, we need to build a strong and trusted profile for our organisation to drive awareness and the credibility of our product/service

- As our company is truly the leading expert in our market sector, we need to position the company and its team as knowledgeable experts and thought-leaders in this sector or application area

- Our audience does not understand our product and the value it can provide them. We need to create content that educates them on how we can help them to achieve more using our product

- We need to support our company’s dealers and distributors through a combination of awareness driving and lead generation activity

- As our prospects would never consider buying a product they have not seen in action, we need to develop a sales process supported by content designed to showcase its capabilities (in order to help the sales team close more details)

- As the market does not understand the flexibility of our product, we need to create content that highlights the different applications of the product

- We are well-known in the marketplace, but we do not have enough leads to pass to the sales team – we need to find a way to generate more leads

- The sales team complains that the leads we pass them are not high enough quality, so we need to develop a methodology for better qualifying the leads we have before passing them to the sales team

- Our sales team is struggling to close sales deals – we need to carefully position our product in the marketplace and highlight its unique value through the development of new sales collateral for the sales team to use.

It’s important not to go after every possible opportunity and/or challenge. Instead, focus on those areas that are essential bottlenecks holding you back or that offer the best possible ROI.

Stage 4.

Setting SMART marketing goals

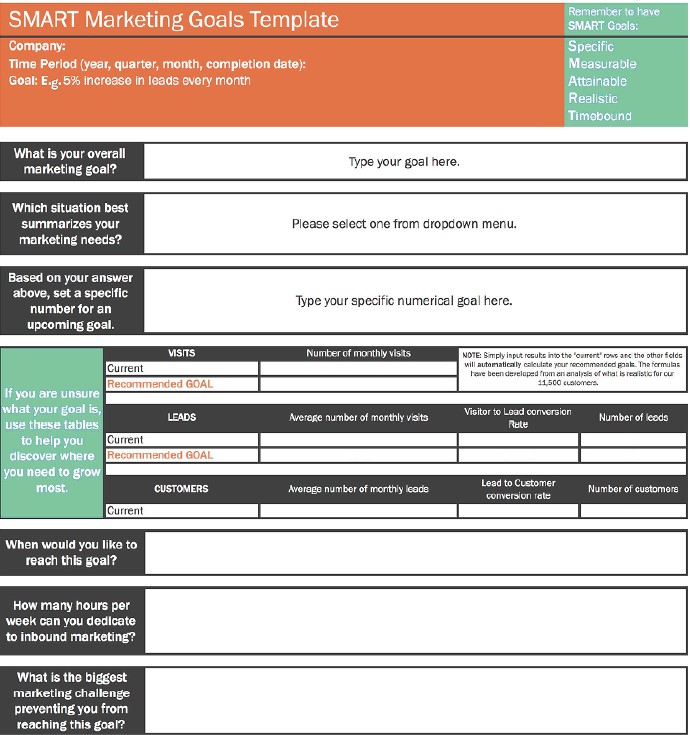

Goals are vital: they help us prove how effective we are, keep us focused, and push us to be better. The thing is, goals are totally useless if they're not grounded in reality. That's why it's critical to interpret your strategy into a series of SMART goals.

It’s hard to reach your destination if you don’t know where you are going. SMART goals help you formalise your objectives by being Specific, Measurable, Attainable, Relevant and Timely.

Here’s what we mean by setting a SMART goal:

- Specific

Your goal should be unambiguous and communicate what is expected, why it is important, who’s involved, where it is going to happen and which constraints are in place - Measurable

Your goal should have concrete criteria for measuring progress and reaching the goal - Attainable

Your goal should be realistic and possible for your team to reach - Relevant

Your goal should matter to your business and address a core initiative - Timely

You should have an expected date that you will reach the goal.

Here are examples of some SMART marketing objectives:

- Increase existing customers purchasing a given product from once every six months to once a quarter by end of December 2016

- Achieve 10% online revenue contribution for consumables within two years

- Increase the average order value of online sales to $1,000 per customer by Q3

- Deliver an increase in leads for a specific product/service from 50 per month to 100 per month by end of the next quarter

- Attract five external key opinion leaders to guest blog on your website by the end of the year

- Develop ten case studies based on data produced by customers working with your leading product by the end of Q4

- Publish one peer reviewed scientific paper validating the power of your platform by the end of 2017.

Stage 5.

Defining your tactical plan

The most effective life science marketing plans make use of all the information covered so far. The real trick is to look at your sales process, align this against your business objectives, identify any underperforming areas and then set (SMART) improvement goals to aim for. With this information, you can construct a tactical plan.

Identifying which tactics will help you reach your business goals

The modern buyer’s journey is important. These days, buyers are increasingly self-educating and turning to sources other than salespeople for information. It’s vital that you provide them with that information, via a wide range of channels (especially your website) during their buying process. There is also usually a clear relationship between your sales process and the buyer’s journey.

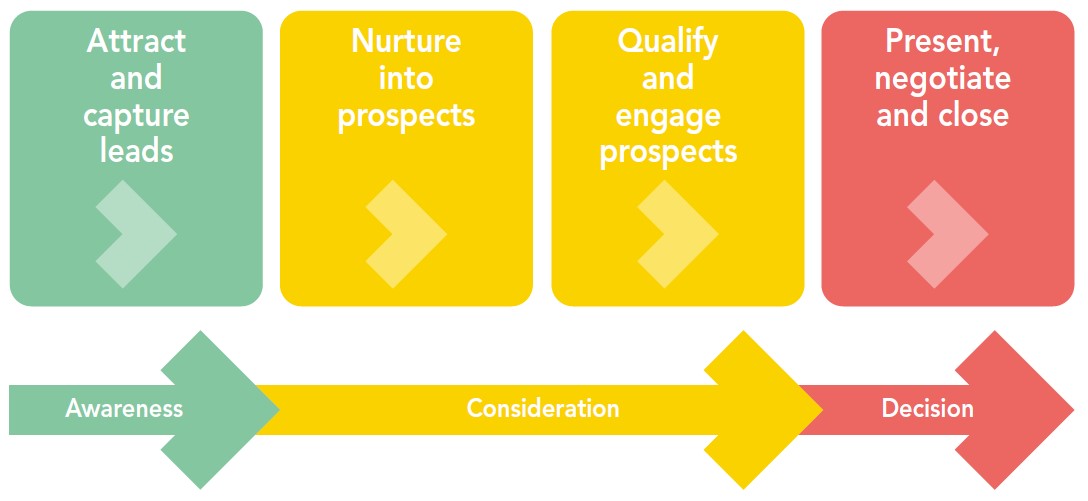

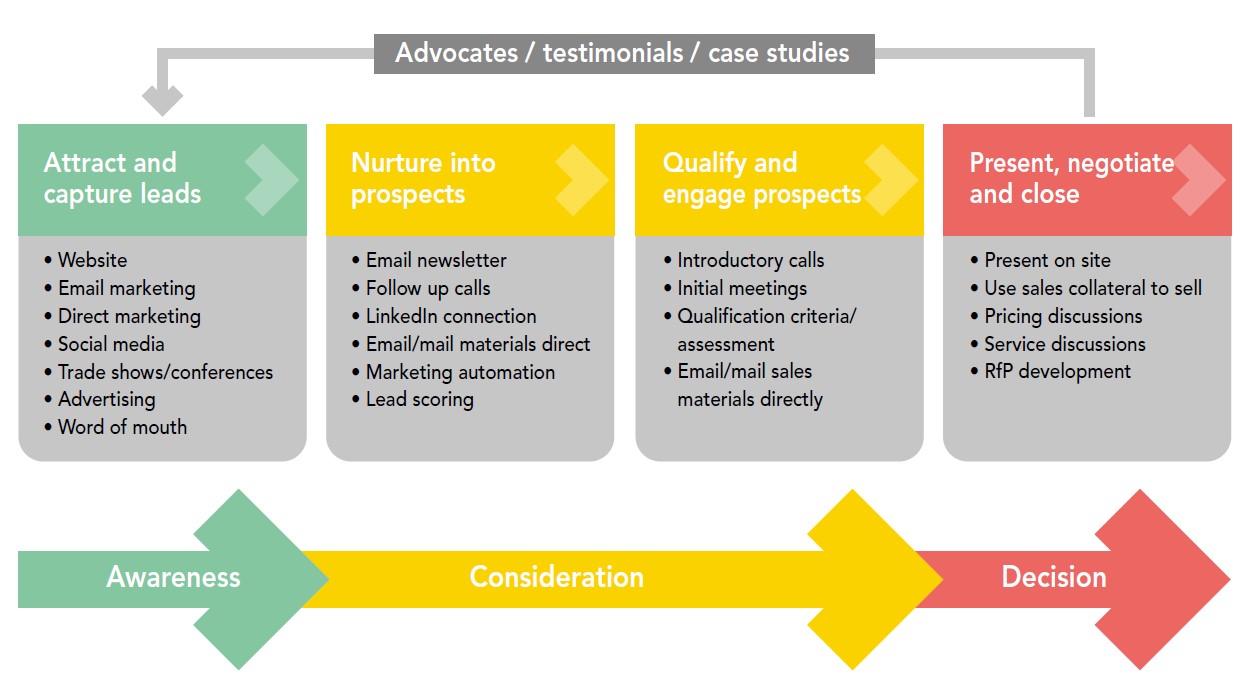

Below you will find a typical sales process:

This process is not as linear as it appears, but it is important to consider each phase if you are to create an effective marketing and sales pipeline. Once you have established your strategy and identified the areas of your sales process that need to most attention, you can look at tactics that will help you reach your goals.

For example, if you know that very few people are aware of your product and this is the major constriction on your sales pipeline, you need to address this by targeting the awareness stage of the buyer’s journey and attract more leads. At the other end of the spectrum, you may be producing a high number of leads, but they may be poorly qualified and your sales team is struggling to know where to focus in order to close deals. In this case, you need to take steps to improve lead qualification before passing them to your sales team. We’ve put together a tactical matrix to help you select tactics that might help you reach your goals.

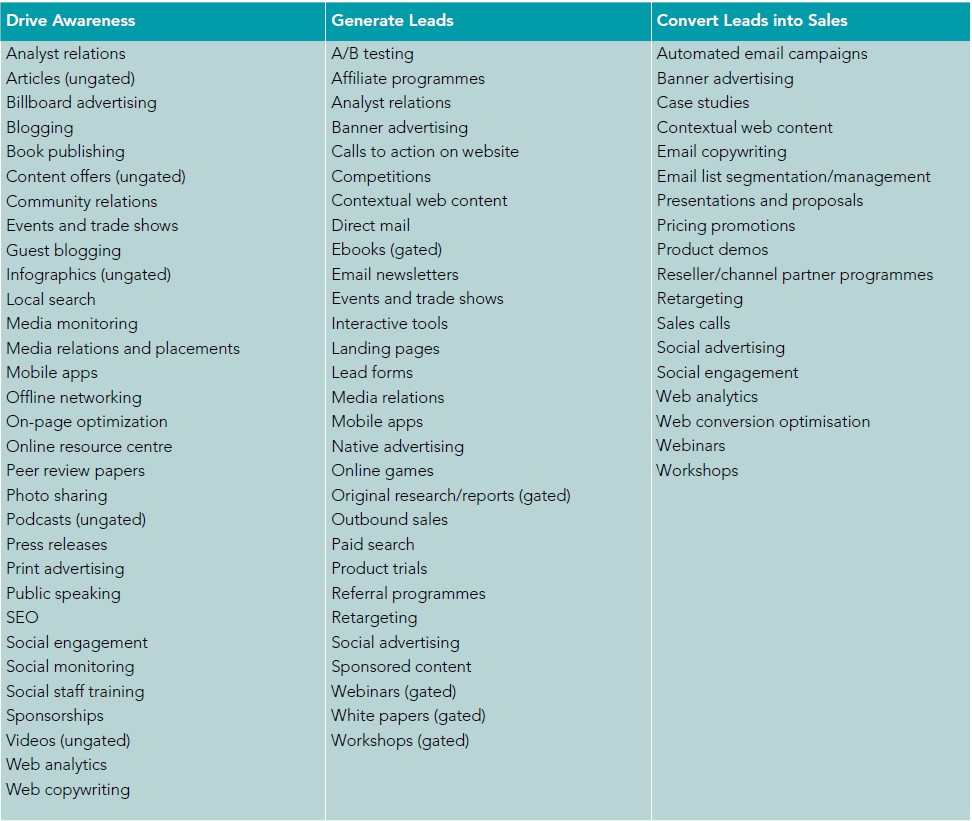

How can you raise awareness of your offering, capture new leads and convert these into sales?

The answer: use a wide array of possible tactics.

Below is a tactical matrix aligned against common marketing goals:

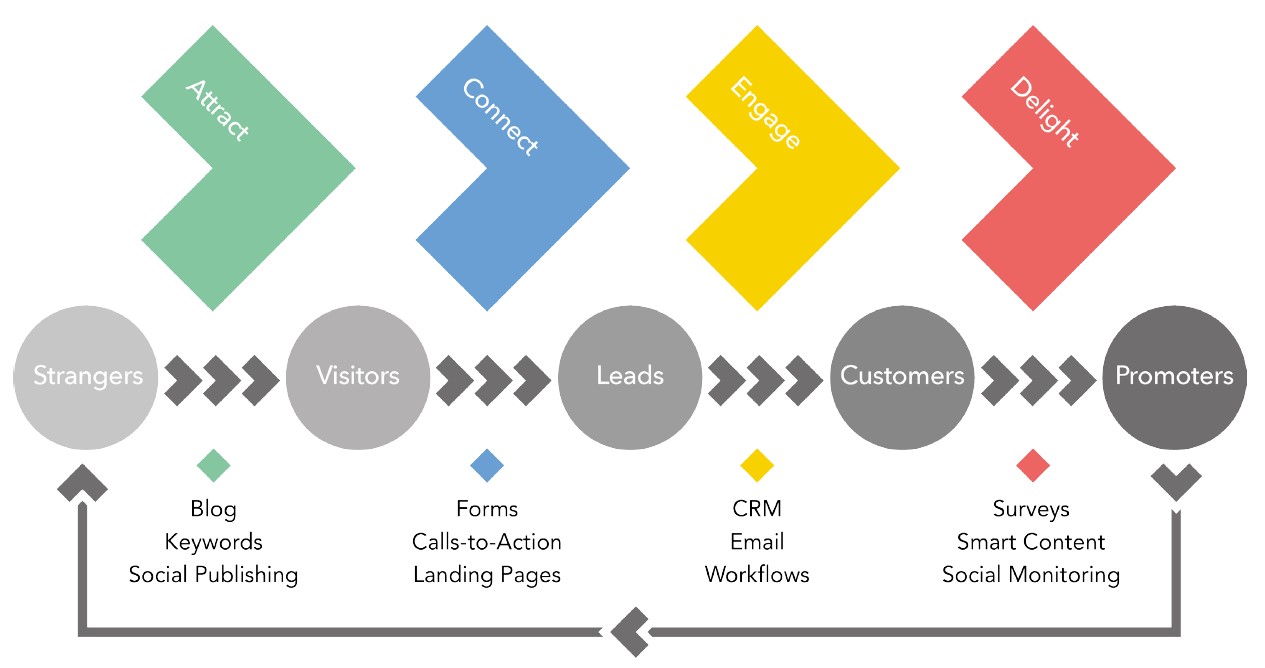

Putting inbound marketing at the heart of your approach

We’ve said it before, but it’s the most important message for modern marketers to hear: the buying process has changed. Your sales team does not own the relationship with the customer, as they are no longer the gatekeepers of information (the internet has seen to that). Instead, the customer is usually at least as well informed as your sales team, requiring a different approach to attract leads and close deals.

For example, nowadays we all thoroughly research our purchases online before making contact with potential suppliers. While we are researching, we are making up our minds about what we need and whom the best supplier is. This happens long before we even make contact with anyone within the company, least of all sales. When businesses share content that helps us understand our problems and how to solve them, it increases the likelihood that a company will reach our shortlist. With each additional piece of content we consume, we become more and more qualified as leads until either we call that company or we are ready for them to call us.

Modern marketers take advantage of this shift in buyer’s behaviour to attract, nurture and close customers. We call this inbound marketing, others call it content marketing. Regardless, the approach involves becoming a publisher and using your website as your main sales tool; after all, it’s the first thing modern prospects visit when they learn about you and it’s ‘always on’, 24 hours a day, 365 days a year. It’s an exciting time for marketers, as we now have more power to effect real change and drive business success by attracting and nurturing leads.

Using content to attract and nurture leads

To be successful at inbound marketing, you need to think strategically. You need to target your buyer personas with content that will nurture them along the buyer’s journey. There are a number of tools for this, but in short, you need to develop content that informs, educates or entertains them to capture their interest, as well as content that convinces them that you are the right vendor to help solve their challenges or help them reach their goals.

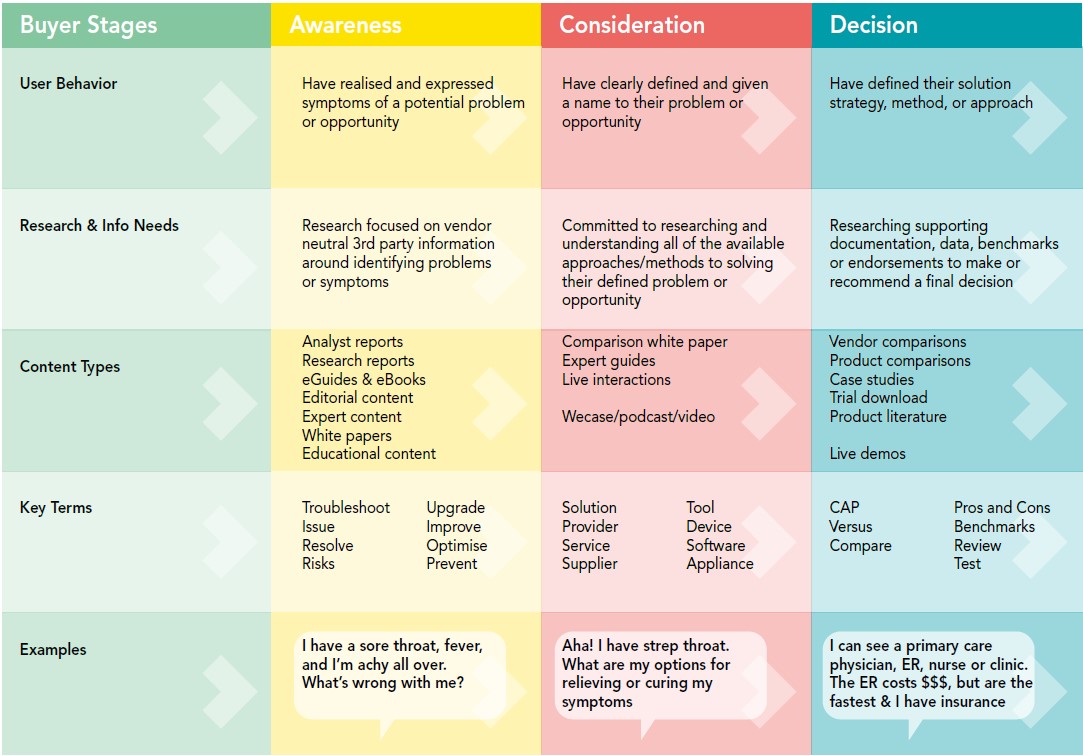

A buyer will usually pass through as many as three different stages on their way to becoming a customer. The key is to create content that can carry your prospects through the process:

- Awareness

They have expressed symptoms of a problem or opportunity. - Consideration

They have defined and given a name to their problem or opportunity. - Decision

They have defined their solution strategy, method or approach.

More details can be found in the graphic below.

Stage 6.

Defining marketing metrics to track performance

Finally, it is vital to ensure that criteria have been set in place to help measure the success of the campaign. During the stage where we set our SMART objectives, we looked into ensuring they were measurable. As a result, setting your marketing metrics should be a relatively straightforward process, but will need a certain amount of cooperation and communication between the marketing and sales teams.

Metrics to monitor

There are a few key metrics you should consider investigating:

- Website visits

Your website is your shop front; it’s the primary place your customers and prospect will be reaching out to you. Keeping track of the total number of visits will help you maintain a finger on the pulse of your marketing success. This is definitely a big picture, rather than nitty gritty metric. - Click-through-rate (CTR)

This measures how many people have clicked on any of your Ads. You can gauge how useful and well positioned they are by looking at your CTR. A good CTR can lead to lower pay-per-click costs because of the pricing discounts offered by platforms like Google Adwords. - Conversion rate (CVR)

How many of your visitors become leads is one of the most valuable metrics you can assess. It literally defines your marketing success. A falling CVR should sound alarm bells whenever you introduce new tactics, it means your visitors and prospects are losing interest in your offering. - Average time on site

This is a great way of assessing how relevant your content is, which is crucial for encouraging people to convert. If people are leaving your site in a very short amount of time, you know that your content is missing the mark and you need to readjust. - Lead to close ratio

This is one for the sales team really as it measures your sales and follow-up success. To arrive at this, divide your total number of sales by your total number of leads. This ratio defines your sales success, but independently of your marketing efforts. - Cost per lead (CPL)

At the end of all this, you need to be converting leads into paying customers without breaking the bank! Your CPL can help determine if you’re spending too much on converting each lead. - Cost to acquire a customer (CAC)

Unlike just CPL, the CAC measures the total marketing and advertising costs over a particular time divided by the number of paying customers generated in that period. This is another broad metric but can be a very useful indicator for looking at general marketing campaign success. - Customer lifetime value (CLV)

This a metric for those businesses that have been established for a while – start-ups will struggle with this. T determine the average customer value, you have to look at all sales the average customer is likely to make over the course of your relationship. While your customer value may be difficult to calculate, it can be a great addition to your overall ROI, especially when repeat business is important (e.g. when selling lab consumables). - Sales revenue

Ultimately, this is what marketing and sales activity should be measured on – revenue. How much money did your efforts bring in? Closed-loop reporting that tracks a prospect as they move through the buying process to becoming a customer can be a great way to connect each of your tactical efforts with how much revenue they brought in.

Marketing tools and platforms

Phew, that’s a lot of metrics! So how can you track all of these? In our experience, every life science company should be looking to track revenue impact with four elements: a solid marketing automation platform, a robust CRM system, a content marketing production space and a web analytics tracking tool. Here are some of the best examples:

- HubSpot is an inbound marketing software platform that helps companies attract visitors, convert leads and close customers, tracking them through every stage. This is our preferred system for executing and monitoring marketing programmes, as it enables closed loop reporting from first touch point to sale (allowing you to truly understand which marketing activities deliver the most prospects and customers).

- Customer Relationship Management (CRM) systems are essential for managing your interactions with your customers, systemising the sales process and maintaining a database of your prospects. Software suites such as Salesforce and HubSpot’s built-in (free) CRM are great tools for this.

- Marketing Evolution is an example of technology that helps marketers create ROI plans while leveraging big data.

- Kapost’s Content Scoring uses technology to tie revenue to individual pieces of content. For example, it could tell you the amount of revenue a single tweet or blog post contributed to the business as a whole.

- Mixpanel gives you the ability to easily measure what people are doing via an app on iOS, Android and the web.

- Lattice Engines provides predictive analytics. Using predictive modelling, it takes conventional data kept by marketers and CMOs, compiles it and crunches it to reveal patterns that confidently predict future buyer behaviour. Predictive analytics allow marketers to more concretely assess what messages or content they should be creating in order to optimize their revenue potential.

It’s also possible to track your non-digital activities (although it can be much harder). Examples include prospect surveys to estimate the proportion of the market that has heard of your company (useful when using PR and advertising to boost brand awareness), and metrics such as tracking the number of leads you captured at a tradeshow or the number of speaker slots you have managed to secure this year for your internal experts.

The most important thing is that you select metrics that allow you to measure your performance against your SMART goals, using systems that will allow you to accurately track these metrics so you can course-correct as needed to drive you towards your business objectives.

"In our experience, every life science company should be looking to track revenue impact with four elements: a solid marketing automation platform, a robust CRM system, a content marketing production space and a web analytics tracking tool."

Stage 7.

Execution

Now that you’ve defined your position, identified the key benefits you can deliver to the marketplace, outlined your buyer personas, put together a strategy to communicate them aligned against gaps in your sales process, set yourself SMART goals and selected tactics to overcome these gaps, you are (finally) ready to execute!

Hopefully this guide will be a big help. You can use it to guide you through the process, from initial market research through to creating your tactical plan.

However, we also realise that you are already likely to be juggling a number of different tasks already and may feel that your team doesn’t have the internal expertise to conduct research, evaluate your sales process and create your tactical plan.

Fear not!

We can help.

Contact us today to find out how we can become a seamless extension of your marketing team and help you develop the ultimate life science marketing and communications strategy tailored to your business.

Visit this link to get started.